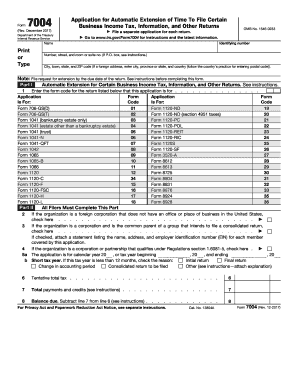

You are only able to E-file the 1st extension the non-automatic additional extension must be paper filed and a reason must be provided. If you need additional time to file, you can file a 2nd extension for an additional 30 days extension. Form 8027 - Employer's Annual Information Return of Tip Income and Allocated Tips.Form 5498-SA - HSA, Archer MSA, or Medicare Advantage MSA Information.Form 5498-ESA - Coverdell ESA Contribution Information.Form 5498 - IRA Contribution Information.Form 1042-S - Annual Withholding Tax Return for U.S.Form W-2G - Guam Wage and Tax Statement.Form 3922 - Transfer of Stock Acquired Through An Employee Stock Purchase Plan.

Form 3921 - Exercise of an Incentive Stock Option.Form 1099 - Reports income self employment earnings, government payments, and more.Form 1098 - Mortgage Interest Statement.Use Form 8809 to request an extension of time to file any of the following forms:

See the chart below that shows the due dates for filing this form. Failure to do so may subject you to penalties. You must file Form 8809 by the due date of the return in order to get the 30-day extension. The form can be submitted on paper or online. If for some reason you cannot get your 1099 or W-2 Form filed on time you can get an automatic 30-day extension of time by completing Form 8809, Application for Extension of Time To File Information Returns. If you need more time to file your W-2 or 1099 forms, you can E-file Form 8809 in just a few minutes from, for an automatic 30 days of extension.

0 kommentar(er)

0 kommentar(er)